Percentage of taxes taken out

The employer portion is 15 percent and the. What percentage of taxes are taken out of payroll.

Tax Deductions For A Home Office Infographic Home Office Home Office Decor Home Office Organization

What is the percentage that is taken out of a paycheck.

. This is because all. Ad Compare Your 2022 Tax Bracket vs. For those who make between 10000 and 20000 the average total tax rate is 04 percent.

Federal income tax and FICA tax. The same goes for the next 30000 12. Find out what percentage of taxes are taken out so you can plan to tax season.

A financial advisor in New York can help you understand how taxes fit into your overall financial goals. However they dont include all taxes related to payroll. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Money deposited in a traditional IRA is treated differently from money in a Roth. FICA taxes are commonly called the payroll tax. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

For a single person making between 9325 and 37950 its 15. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. Given that the second tax bracket is 12 once we have taken the previously taxes 10275 away from 27050 we are left with a total taxable amount of 16775. You can have 10 in federal taxes withheld directly from your pension and.

The current rate for. Discover Helpful Information And Resources On Taxes From AARP. There is no universal federal income tax percentage that is applied to everyone.

The average tax rate for taxpayers who earn over 1000000 is 331 percent. You fill out a pretend tax return and calculate that you will owe 5000 in taxes. Your Federal Income Tax You would be taxed 10 percent or 900 which averages out to 1731 out of each weekly paycheck.

Federal income taxes are also withheld from each of your paychecks. Your 2021 Tax Bracket To See Whats Been Adjusted. What Is the Percentage of Federal Taxes Taken out of a Paycheck.

How Your Paycheck Works. Individuals who make up to 38700 fall in the 12 percent tax. That is a 10 rate.

After taking 12 tax from that. In the Federal tax code there are 7 different tax brackets ranging from. FICA taxes consist of Social Security and Medicare taxes.

505 on the first 44470 of taxable income. How Your New Jersey Paycheck Works. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

If its not you will. Financial advisors can also help with investing and financial planning - including. A single person making between 0 and 9325 the tax rate is 10 of taxable income.

Self-employed individuals have to pay the full 29 in Medicare taxes and 124 in Social Security taxes themselves as there is no separate employer to contribute the other half. 915 on portion of taxable income over 44470 up -to 89482. The good news is.

These taxes together are called FICA taxes. Your employer uses the information that you provided on your W-4 form to. How much tax is taken off a paycheck in Ontario.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

4 Tax Tips For Small Business Owners Tips Taxes Taxtime Income Tax Tips Tax Return Tips Small Business Tax Business Business Advice

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

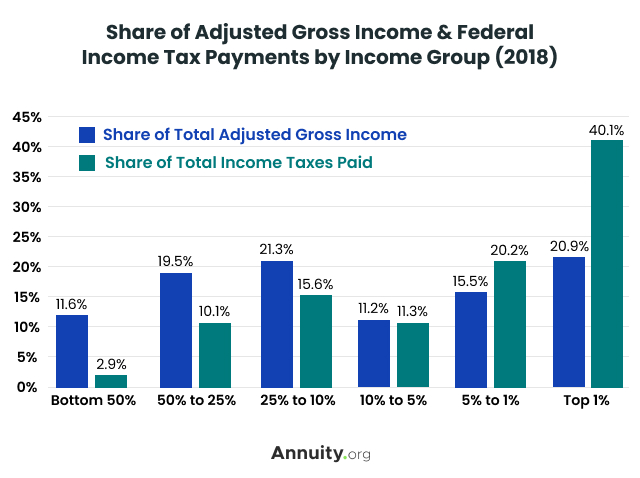

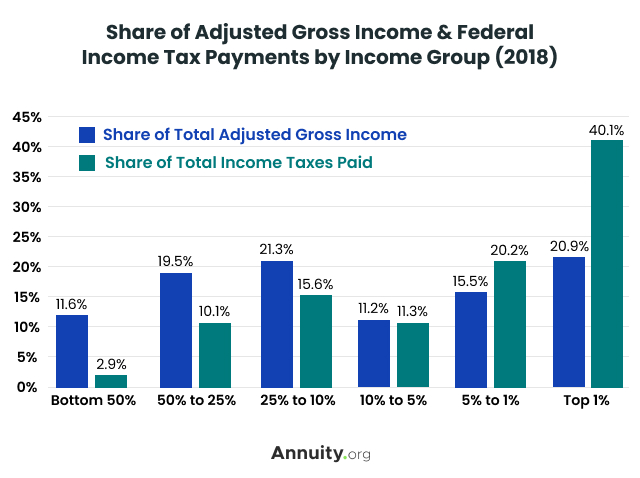

In 1 Chart How Much The Rich Pay In Taxes The Heritage Foundation

Sales Tax Anchor Chart Math Anchor Charts Anchor Charts 7th Grade Math

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Income Tax Definition What Are Income Taxes How Do They Work

Government Revenue Taxes Are The Price We Pay For Government

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

This Is What You Need To Know The First Year You File Business Taxes

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

New Data Offer First Infuriating Glimpse At How The Richest 0 0001 Pay Taxes Income Tax Income Paying Taxes

Taxes On Americas Favorite Beverage Soda Infographic Soda Tax Infographic Health Food Infographic

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Government Revenue Taxes Are The Price We Pay For Government

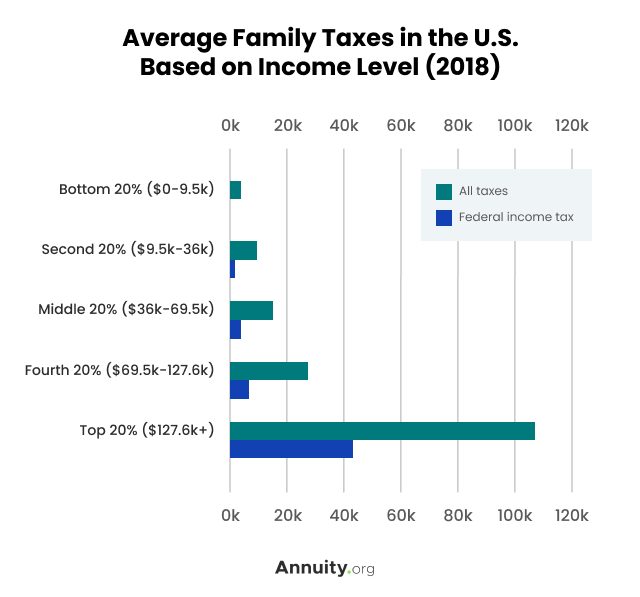

Pin On Sociology Visuals Economy

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Tax Information What Are Taxes How Are They Used